Leased Ad Space

1. Overview of Malaysia

Malaysia is located in Southeast Asia, with an area of approximately33Thousands of square kilometers and a long coastline 4192 kilometer. Malaysia is located near the equator and belongs toTropical rainforest climate and tropical monsoon climate, with high temperature and rain all year round, no obvious four seasons.

2024 annual population 3420 Ten thousand, per capita GDP about 11649 Dollar. According to World Bank standards, Malaysia is an upper-middle-income country. Malaysia is a multi-ethnic and multi-cultural country. The official religion isIslam.

The territory is rich in nature,The production and export volumes of rubber, palm oil and pepper rank among the top in the world. It is rich in oil reserves, as well as iron, gold, tungsten, coal, bauxite, manganese and other minerals. Rich in tropical hardwoods. In the primeval forest, there are rare animals and birds that are on the verge of extinction, such as flying lemurs, long-limbed brown-haired giant apes, white rhinos, orangutans, etc. There are also many wild animals such as birds, snakes, crocodiles, and insects. Orchids, giant apes and butterflies are known as the three treasures.

2. Overview of Malaysian Steel

exist 2013 to2016 During the year, due to factors such as dumping of cheap steel, Malaysia’s annual crude steel output once fell to 300 to 400 A lower level of 10,000 tons. But since 2016 After the year, its crude steel output began to bottom out and rebound, showing strong recovery momentum.

According to the World Steel Association 2024 Annual crude steel production data, Malaysia 2023 Annual crude steel production is approximately 750 Thousands of tons,2024 Annual crude steel production is approximately 880 million tons, ranking third in ASEAN,world 20 About a bit, compared with 2015 Years increased 214%.

Malaysia is one of the important steel-producing countries in Southeast Asia. The scale of its steel industry continues to expand and its output value grows steadily. At present, Malaysia's steel industry is mainly concentrated in West Malaysia, with steel plants in Kuala Lumpur, Selangor, Penang, Malacca and other areas concentrated.

According to the Southeast Asian Iron and Steel Association, Malaysia’s current steel production capacity 1610 Thousands of tons. Although there are many steel plants, their scale is generally small..

In recent years, Chinese-funded enterprises such as Jianlong Steel and Wen'an Steel have invested in Malaysia. Many local new blast furnace process production capacities have been completed one after another. According to the Southeast Asian Iron and Steel Association, by 2025 The country’s new crude steel production capacity is expected to exceed 2000 Thousands of tons.

3. Major steel companies in Malaysia

According to data from the Southeast Asia Iron and Steel Association, although Malaysia has a large number of steel plants, their scale is generally small. Except for ten larger steel plants, the rest are small and medium-sized steel plants. The major steel companies include Golden Lion Group, Anyu Steel Company, Sinosteel Malaysia, Nanda Steel Company, and East Steel Corporation of Malaysia.

(1) Golden Lion Group (The Lion Group)

Golden Lion Group’s assets include two steel mills in Malaysia with an annual output of 3 million tons, mainly producesConstruction steel, wire rod, rebarwait.exist 1978 In 2006, Golden Lion obtained an operating license and became the largest steel production plant in Malaysia.1985 In 2016, after the company further expanded its scale, its annual steel output exceeded 85 million tons, firmly occupying the leading position in Malaysia's steel production. So far, the production capacity of Golden Lion Steel Plant has accounted for 1% of Malaysia’s national steel production.60% above

(2)Malaysian Steelgroup(Malaysia Steel Works)

Matie Group was founded in 1971, is one of the largest steel plants in Malaysia and one of the most important steel producers in Southeast Asia. The company mainly produces steel bars, steel plates, and steel pipes,High strength steel bars, mild steel bars and premium steel billets for construction and infrastructure engineering. The annual production capacity reaches 150 Thousands of tons.

(3)Oriental Steel (Eastern Steel)

Dongfang Steel was founded in 1982 In 2006, it was a steel plant that mainly produced steel plates and steel bars. It is located in Penang, Malaysia, with an annual production capacity of 300 10,000 tonsabove.

2024 Year,Eastern Steel 1450mm The commissioning of the steel rolling project marks the comprehensive completion and commissioning of the second phase of the Malaysian East Steel Project.It has opened up the entire industrial chain of the Malaysian steel industry and filled the gaps in its industrial chain in the fields of construction, home appliances, automobiles and other fields.

The company has developed into a comprehensive steel complex integrating coking, sintering, ironmaking, steelmaking, silicon-manganese alloys and power generation. Its products are sold throughout Malaysia and are also sold to Southeast Asian and East Asian countries and regions such as Thailand and Vietnam.

(4) Anyu Steel(ANNJOO)

Founded in 1961 year, it was the first company in Southeast Asia to obtain both 3 An internationally renowned certified steel plant. It adopts short-process joint production technology and is mainly engaged in short-process joint production integrating smelting, steel rolling and scientific research. Its main products include steel billets,Threaded pipe,Low carbon round steelandsteel barwaitLong products, widely used in construction, machinery manufacturing and other fields, and exported to Europe, the Middle East, the Far East and other regions.The annual production capacity reaches 200 Thousands of tons.

(5) United Steel(Alliance Steel)

United Steel(malaysia)The group company was founded in 2014 Year 4 In September, it is located in Pahang, the capital of Malaysia and the largest city in the East Coast Special Economic Zone.-Kuantan, located near Kuantan Port. It is a joint steel enterprise between Malaysian and Chinese enterprises.

The main products are: wire rods, bars and sections, with an annual output of 400 Thousands of tons. The investment in the second phase of the planned expansion project is approximately 18 billion US dollars, covering an area of approximately 770 Acres, Steel Products Increase 320 Ten thousand tons of hot-rolled thin plates, the hot-rolling line adopts "endless rolling", and a high-end steel plate production line will be added. After the second phase of production is put into operation, it will increase 2500 jobs. At present, the company has obtained approval from Southeast Asia, Europe and the United States, etc.20 Management system certification and user approval in multiple countries.

(6) Nanda Steel(Southern Steel)

Nanda Steel Annual Production Capacity 150 million tons, the steel plant is located in Klang, Malaysia (Klang) and Pula (Prai)area. Produces a variety of high-quality steel products, including hot-rolled steel billets, industrial and construction wire rods, mild steel round bars and high-yield deformation steel bars for construction.

(7)huge steel (Melewar Steel)

Giant Steel was founded in 1979 In 2006, it was a steel plant that mainly produced steel plates and steel bars. It is located in Selangor, Malaysia, with an annual production capacity of 100 Thousands of tons.

(8)Jinshan Iron and Steel (Kinsteel)

Jinshan Iron and Steel was founded in 1997 In 2006, it was a steel plant that mainly produced steel plates and steel bars. It is located in Selangor, Malaysia, with an annual production capacity of 70 Thousands of tons.

(9)Malacca Steel (Malacca Steel)

Malacca Steel was established in 1989 In 2006, it was a steel plant that mainly produced steel plates and steel bars. It is located in Malacca, Malaysia, with an annual production capacity of 50 Thousands of tons.

4. Malaysian steel market demand

(1) overall demand

The construction industry has always been an important pillar of the Malaysian steel industry, accounting for as much as63%, is the absolute main consumer, followed by the metal processing industry and the electronics and semiconductor industry. The automobile industry is the main user of high-end steel.Perodua,Proton As car companies drive demand, home appliances and machinery manufacturing are also growing steadily.

According to data released by the Southeast Asia Iron and Steel Association,2023 ASEAN 6 Year-on-year steel demand growth in countries (Vietnam, Indonesia, Thailand, Philippines, Malaysia and Singapore)3.4%,achieve 7760 Thousands of tons. in,2023 Malaysia’s steel demand expected to grow year-on-year 4.1%,achieve 780 Thousands of tons.

(2)Construction and automobiles are the main industries that demand steel

The downstream applications of Malaysian steel are mainly in real estate construction and automobile production, and the demand for plates is relatively strong. In terms of automotive steel, as one of the few countries in Southeast Asia with a relatively complete automotive industry chain, Malaysia is the largest passenger car producer in ASEAN. 2020 Malaysia ranks first in the world in terms of car ownership 9, the number of cars per 1,000 people reaches 433 vehicle,It is the only developing country among the top ten countries. The main reason is that Malaysia's industrial development was earlier, but the cities are scattered and the public transportation system is imperfect. In addition, due to rich oil resources, fuel costs are low, and the cost of using cars is relatively low. Driven by the above factors, the Malaysian automobile industry has developed relatively prosperously. In terms of steel for construction, due to Malaysia's strategic location, it is an important transit point for international trade, and a large number of people have settled in Malaysia, which has led to greater demand for commercial housing, industrial housing and national infrastructure construction. The prosperity of the construction industry has also promoted the increase in consumption in Malaysia's domestic steel market.

(3) Per capita steel consumption is low

Malaysia's per capita steel consumption remains lower than similar countries, reflecting slower growth in domestic demand. Malaysia’s steel industry is made up of a mix of private and state-owned companies and relies heavily on imported raw materials (compared to Indonesia, Malaysia lacks abundant reserves of key minerals such as nickel). Despite these challenges, the Malaysian government continues to prioritize and prioritize the steel industry as a key component of its economic and infrastructure development.

(4) excess capacity

2023 Year 8 moon 15 Japan, Malaysian Ministry of Investment, Trade and Industry (Ministry of Investment, Trade and Industry)MITI) imposed a two-year moratorium on steel investment approvals for the steel industry. This decision aims to address the challenges existing within the industry and align its development direction with NIMP 2030 Realign. The moratorium covers all activities related to applications, licensing, business diversification and manufacturing, except for support NIMP 2030 Agenda license applications may be granted exceptions on a case-by-case basis.

Although the Malaysian steel industry faces overcapacity issues, especially in low-end products such as rebar and wire rod, there is still a supply gap for flat products. Currently, hot rolled coils (HRC) and other high-end steel products have not yet been produced in Malaysia and still rely on imports. The moratorium provides an opportunity for Malaysian steelmakers to increase production capacity, allowing them to focus on higher value-added steel products to meet domestic demand while resolving overcapacity issues. This strategic transformation is expected to help Malaysia reduce its dependence on imported steel and enhance its competitiveness in the global steel market.

A key condition for exemptions from the steel industry moratorium is compliance with Malaysia’s decarbonization agenda. Permit applications that promote low-carbon steel products or adopt carbon-reducing technologies are more likely to be approved. A typical case is Esteel Enterprise Sabah Sdn Bhd At 2022 announced in the year 200 100 million ringgit green steel project, which aims to achieve higher furnace-Converter (BF-BOF) Steel production routes are reduced 70% of carbon emissions.

(5) Demand Outlook

As a global semiconductor and electronics industry base, Malaysia's demand for related steel products (such as stainless steel) continues to grow. Looking to the future, with the 2030 With the advancement of the New Industrial Master Plan in 2020, the consumption of the Malaysian steel industry is expected to maintain steady growth.2025 It is expected to reach 860 million tons, with an average annual growth rate of approximately3%.

5. Import and export of Malaysian steel

(1)exit

In recent years, Malaysia’s steel exports have shown an overall growth trend.2024 The annual export volume reaches 940 million tons, significantly higher than 2018 years 170 10,000 tons, also exceeded 2020 Although the year-on-year growth rate of exports has slowed down, the overall scale has steadily expanded. Imports are relatively stable.2024 The annual total is 810 Thousands of tons. since2020Since 2006, Malaysia has achieved net exports of steel for five consecutive years, and its net export structure has initially taken shape. However, it is worth noting that the steel industry is still highly dependent on foreign countries, and there are still outstanding contradictions in the variety structure, especially.

From the perspective of export flows, Türkiye is Malaysia’s largest export destination, accounting for up to 29%. Hongkong(17%) and Singapore (15%) also occupies a significant share as a re-export hub, which is conducive to the further flow of Malaysian steel to wider Asia-Pacific or European and American markets. Several other major exporting countries show that the export market has a certain degree of decentralization.

Exports tend to be primary products, mainly steel billets (28%), rebar (20%), wire (13%) mainly belong to the category of long products and primary raw materials; high value-added products such as coated sheets and alloy steel account for a lower proportion.

(2)import

In terms of imports, China is Malaysia’s largest source of steel, accounting for up to 37%, accounting for almost 40% of the overall import market. Later, Vietnam (12%),Japan(12%), Taiwan, China (10%),South Korea(10%), showing that the steel supply chain is highly dependent on East Asia, and other ASEAN countries also occupy a certain share. This Asia-dominated import pattern is conducive to transportation cost control, but it also exposes the risk of dependence on supplies from specific regions.

The structure of imported varieties is mainly concentrated in wire rod (twenty two%), pipes (15%), iron products (12%) and steel billet (9%) and other intermediate products; in addition, there are also cold-rolled products (9%), cold formed steel (9%), hot rolled coils (5%) and other flat material categories, which are widely used in manufacturing, automobiles, electrical appliances and other finishing industries, showing that high-end production capacity is still insufficient.

6. Shortcomings of Malaysian Steel

(1) structural imbalance

The problem of structural imbalance in production capacity is very prominent.,The current output of long products (such as rebar and wire rods) accounts for as much as 83%, mainly supplied to the construction and infrastructure fields; flat materials (such as hot-rolled, cold-rolled, coated plates, etc.) only account for 17%, while manufacturing, electrical appliances, automobiles and other fields are highly dependent on flat materials, and the import substitution rate is low, which has become a key bottleneck restricting the upgrading of the local manufacturing chain.

(2) Relatively scarce mineral resources

From a resource perspective, Malaysia BF-BOF Steel production is mainly driven by local iron ore. Malaysia’s annual domestic iron ore production is approximately 600 Thousands of tons, most of which require beneficiation before being used for steel production. In addition to this, Malaysia also imports approximately 500 tons of iron ore to meet demand. Although Malaysia has a small number of coking coal mines, most of its coking coal still needs to be imported. In addition, Malaysia's abundant resources of auxiliary materials such as bauxite and tin provide a resource base for primary steel manufacturing.

(3)The technology is relatively backward

Due to the lack of iron ore resources, Malaysian steel mills generally use electric arc furnaces (EAF)+The production route of continuous casting and rolling, the raw materials are scrap steel and HBI Mainly, energy saving and emission reduction have obvious advantages. In contrast, having a blast furnace—Converter (BF-BOF) integrated process steel plants are extremely scarce. Currently, only United Steel and Dongfang Steel have blast furnace production lines.

(4) Import and export category imbalance

exit"Initialization",import"High-end"structure, reflectingMalaysiaThe steel industry is still in the middle and lower reaches of the industrial chain and still needs to extend to high-end processing.

7. Advantages of Malaysian Steel

(1) location advantage

The Malaysian steel industry has significant geographical concentration advantages. The main steel plants are concentrated in the states of Pahang, Terengganu, Selangor and Penang in Peninsular Malaysia, forming efficient linkage with key ports. Port Klang (Port Klang) is the largest trading port in Malaysia, supporting the transportation of raw materials and products for steel mills in the Snow Slope area; Kuantan Port and Kemaman Port (Kuantan & Kemaman Port) is close to United Steel and Oriental Steel and is an important channel for blast furnace companies; Johor Bahru Port and Tanjung Pelepas Port (Johor Port & Port of Tanjung Lepas) is connected to Singapore and export markets; Bintulu Port (Bintulu Port) to support East Malaysia’s steel supply.

The high matching between steel plants and ports has established an efficient logistics system covering the whole country, especially supporting the smooth flow of flat steel imports and long steel exports.

(2) natural gas is abundant

Malaysia is endowed with abundant natural gas resources, and the fossil fuel plays a central role in its economy as a key industry and one of the country's main exports. Countries such as the United States and Iran have used their respective natural gas reserves to promote direct reduced iron (DRI) production, thus forming a steel industry with lower carbon emissions and more competitive product prices than Malaysia. although DRI-EAF The route requires direct reduction grade iron ore, but Malaysia has available magnetite deposits, so in theory it would be possible to produce direct reduction grade ore with minimal beneficiation processes. Given its abundant natural gas resources and scarce coking coal resources, Malaysia could have achieved DRI Transformation of steel production. However, the industry is affected by technology exports and relies instead on BF-BOF Craftsmanship. Going forward, Malaysia should look beyond the natural gas reductant stage and directly utilize existing resources and infrastructure to develop green H2-DRI-EAF The transformation route of the route.

8. Challenges faced by Malaysian steel

(1) Challenges of overcapacity and technical routes

The Malaysian steel industry is suffering from overcapacity and stagnant demand, which determines the enthusiasm of steel companies for decarbonization initiatives. Most companies are not focusing on decarbonization measures, but are focusing on coping with the survival dilemma caused by stagnant consumption and global steel overcapacity.

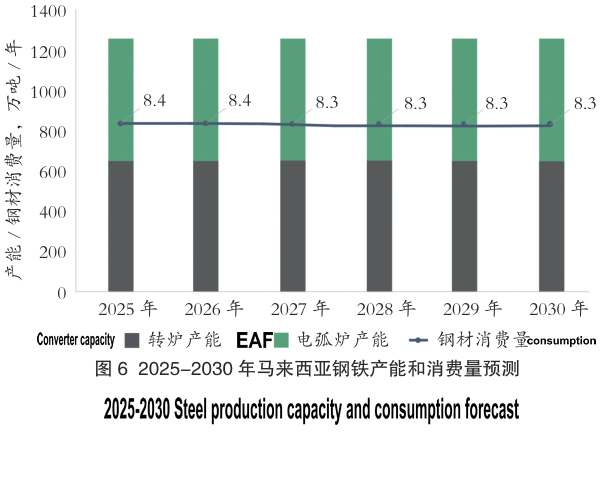

picture6 right 2025-2030Forecasts for Malaysia’s steel production capacity and consumption in 2020 indicate that weak steel consumption is expected to continue into 2030 This year, the reason is that consumption in the construction industry remains stable and Malaysia still relies on imports in the field of higher grade steel. Currently, Malaysia's steel consumption is dominated by the construction industry, which uses a large amount of lower quality and cheaper long products. Despite strong demand for flat steel, Malaysia’s domestic production capacity is limited. Due to saturated domestic demand, about half of long products are exported overseas.

New greenfield steel plant in 2030 It is unlikely to enter the market before the year,Although this may help avoid further overcapacity. In addition, there have been nearly 1200 Annual production capacity of 10,000 tons BF-BOF Construction of the steel plant project was announced. It is worth noting that the annual production capacity 1000 The 10,000-ton Hebei Xinwuan Steel Plant is Malaysia’s largest steel project to date. The project has been hit by repeated delays and a depressed market, and it remains in its early stages.500 The land leveling work stage with an annual production capacity of 10,000 tons.

Malaysia has limited leverage to push for decarbonization as it grapples with overcapacity and lower-than-expected consumption growth. although DRI The related process is attractive, but without policy and financial support, its practical application may still take a long time.

arrive2030Emissions from Malaysia's steel industry are expected to level off in 2018, reflecting limited investment in new technologies to improve efficiency or reduce emissions. The Malaysian market is promoting technologies to improve energy efficiency, but these technologies have limited impact on overall emissions reductions. large scale BF-BOF Energy efficiency technologies focus primarily on coke and gas utilization within long-flow steel plants, often promising achievable 2%-5% of emission reductions.BF-BOF The process is already one of the most energy-efficient industrial processes in the world, and its operation is close to the theoretical energy consumption limit. Therefore, there is very limited room for further energy efficiency improvement and emission reduction.

(2) Challenges from the external environment

Malaysian steel trade friction escalates:

As the scale of steel imports and exports expands, Malaysia is increasingly involved in global steel trade frictions.2018 Since the year, Malaysia has initiated more than ten anti-dumping cases against many countries, covering cold-rolled, rebar, wire rod and other products, with tax rates up to 30%, highlighting its determination to strengthen the protection of Malaysia’s local steel industry.

At the same time, Canada, the United States, Australia, Vietnam and other countries have also launched multiple anti-dumping investigations against Malaysian products. The products involved include welded pipes, concrete steel bars, hot-rolled coils, etc., with tax rates ranging from 10%-25% between. malaysia faces"Export restricted"and"import defense"Due to dual pressures, the trade environment has become more complex.

9. Policy environment

The Malaysian government supports the development of the steel industry through a number of policies:

(1) "Malaysian Steel Industry Blueprint (2021-2030)" emphasizes increasing added value, green manufacturing and industrial integration, with goals including increasing the self-sufficiency rate to 80% The above will promote the transformation of the industry towards high value-added.

(2) trade protection measures, taking anti-dumping duties, import licenses and other measures to protect local companies, but they also face WTO rules and regional trade agreements.

(3) Environmental protection and carbon emission reduction. According to the Paris Agreement, the government promotes steel companies to reduce carbon emissions, encourages the use of scrap steel and renewable energy, and provides tax incentives.2021 announced in"2050 annual carbon neutrality target"further strengthened this policy orientation.

(4) foreign investment policy encourages foreign investment in high-end technology and export-oriented projects, but limits the proportion of foreign equity in some areas. "National Investment Vision"2030》Proposed to attract high-quality investment and promote industrial upgrading.

Web: https://www.sinosteel-pipe.com/en

email: contact@sinosteel-pipe.com

About Xing Bowen

This member hasn't told us anything about themselves yet! Encourage them to do so!